Crypto Currency Research Data from Coin-Market Cap without Survivorship Bias

Get crypto2 from CRAN or https://github.com/sstoeckl/crypto2

Get crypto2 from CRAN or https://github.com/sstoeckl/crypto2| Project Status | CRAN Status | CRAN downloads | Lifecycle | Website | ||

|---|---|---|---|---|---|---|

|  |

In the past two years an ever-growing number of academic researchers has been investigating the market for cryptocurrencies (CC), often concentrating on the few largest ones (Brauneis and Mestel 2018; Bouri, Gupta, and Roubaud 2018; Corbet et al. 2018). However, in almost all studies only the surviving cryptocurrencies are considered and thereby all results are subject to survivorship bias.

Cryptocurrency data that is not subject to survivorship bias is hard

to obtain, therefore I have created my own package

crypto2 that is now

available from CRAN.

Historical Cryptocurrency Prices for Active and Delisted Tokens!

This is a modification of the original crypto package by jesse

vent. It is entirely set up to use

means from the tidyverse and provides tibbles with all data

available via the web-api of

coinmarketcap.com. It does not require

an API key but in turn only provides information that is also available

through the website of

coinmarketcap.com.

It allows the user to retrieve

crypto_listings()a list of all coins that were historically listed on CMC (main dataset to avoid delisting bias) according to the CMC API documentationcrypto_list()a list of all coins that are listed as either being active, delisted or untracked according to the CMC API documentationcrypto_info()a list of all information available for all available coins according to the CMC API documentationcrypto_history()the most powerful function of this package that allows to download the entire available history for all coins covered by CMC according to the CMC API documentationcrypto_global_quotes()a dataset of historical global crypto currency market metrics to the CMC API documentationfiat_list()a mapping of all fiat currencies (plus precious metals) available via the CMC WEB APIexchange_list()a list of all exchanges available as either being active, delisted or untracked according to the CMC API documentationexchange_info()a list of all information available for all given exchanges according to the CMC API documentation

Update

Version 2.0.2 (August 2024)

Slight change in api output broke crypto_info() (new additional

column). Fixed.

Version 2.0.1 (July 2024)

Slight change in api output broke crypto_info(). Fixed.

Version 2.0.0 (May 2024)

After a major change in the api structure of coinmarketcap.com, the package had to be rewritten. As a result, many functions had to be rewritten, because data was not available any more in a similar format or with similar accuracy. Unfortunately, this will potentially break many users implementations. Here is a detailed list of changes:

crypto_list()has been modified and delivers the same data as before.exchange_list()has been modified and delivers the same data as before.fiat_list()has been modified and no longer delivers all available currencies and precious metals (therefore only USD and Bitcoin are available any more).crypto_listings()needed to be modified, as multiple base currencies are not available any more. Also some of the fields downloaded from CMC might have changed. It still retrieves the latest listings, the new listings as well as historical listings. The fields returned have somewhat slightly changed. Also, no sorting is available any more, so if you want to download the top x CCs by market cap, you have to download all CCs and then sort them in R.crypto_info()has been modified, as the data structure has changed. The fields returned have somewhat slightly changed.crypto_history()has been modified. It still retrieves all the OHLC history of all the coins, but is slower due to an increased number of necessary api calls. The number of available intervals is strongly limited, but hourly and daily data is still available. Currently only USD and BTC are available as quote currencies through this library.crypto_global_quotes()has been modified. It still produces a clear picture of the global market, but the data structure has somewhat slightly changed.

Version 1.4.7

Since version 1.4.6 I have added the possibility to “sort” the

historical crypto_listings() in _asc_ending or _desc_ending order

(“sort_dir”) to allow for the possibility to download only the top x

crypto currencies using “limit” based on the requested sort (not

available for “new” sorting). Also corrected some problems when sourcing

lists that now do not have the “last_historical_data” field available

any more.

Since version 1.4.5 I have added a new function crypto_global_quotes()

which retrieves global aggregate market statistics for CMC. There also

were some bugs fixed.

Since version 1.4.4 a new function crypto_listings() was introduced

that retrieves new/latest/historical listings and listing information at

CMC. Additionally some aspects of the other functions have been

reworked. We noticed that finalWait = TRUE does not seem to be

necessary at the moment, as well as sleep can be set to ‘0’ seconds.

If you experience strange behavior this might be due to the the api

sending back strange (old) results. In this case let sleep = 60 (the

default) and finalWait = TRUE (the default).

Since version 1.4.0 the package has been reworked to retrieve as many

assets as possible with one api call, as there is a new “feature”

introduced by CMC to send back the initially requested data for each api

call within 60 seconds. So one needs to wait 60s before calling the api

again. Additionally, since version v1.4.3 the package allows for a data

interval larger than daily (e.g. ‘2d’ or ‘7d’ or ‘weekly’)

Installation

You can install crypto2 from CRAN with

install.packages("crypto2")

or directly from github with:

# install.packages("devtools")

devtools::install_github("sstoeckl/crypto2")

Package Contribution

The package provides API free and efficient access to all information

from https://coinmarketcap.com that is also available through their

website. It uses a variety of modification and web-scraping tools from

the tidyverse (especially purrr).

As this provides access not only to active coins but also to those that have now been delisted and also those that are categorized as untracked, including historical pricing information, this package provides a valid basis for any Asset Pricing Studies based on crypto currencies that require survivorship-bias-free information. In addition to that, the package maintainer is currently working on also providing delisting returns (similarly to CRSP for stocks) to also eliminate the delisting bias.

Package Usage

Coin Listing

First we load the crypto2-package and download the set of active coins

from https://coinmarketcap.com (additionally one could load delisted

coins with only_Active=FALSE as well as untracked coins with

add_untracked=TRUE).

library(crypto2)

library(dplyr)

# List all active coins

coins <- crypto_list(only_active=TRUE)

head(coins)

## # A tibble: 6 × 7

## id name symbol slug is_active first_historical_data last_historical_data

## <int> <chr> <chr> <chr> <int> <date> <date>

## 1 1 Bitco… BTC bitc… 1 2010-07-13 2025-01-15

## 2 2 Litec… LTC lite… 1 2013-04-28 2025-01-15

## 3 3 Namec… NMC name… 1 2013-04-28 2025-01-15

## 4 4 Terra… TRC terr… 1 2013-04-28 2025-01-15

## 5 5 Peerc… PPC peer… 1 2013-04-28 2025-01-15

## 6 6 Novac… NVC nova… 1 2013-04-28 2025-01-15

Coin Information

Next we download information on the first three coins from that list.

# retrieve information for all (the first 3) of those coins

coin_info <- crypto_info(coins, limit=3, finalWait=FALSE)

## ❯ Scraping crypto info

##

## ❯ Processing crypto info

##

# and give the first two lines of information per coin

coin_info

## # A tibble: 3 × 36

## id name symbol slug category description date_added status sub_status

## <int> <chr> <chr> <chr> <chr> <chr> <date> <chr> <chr>

## 1 1 Bitcoin BTC bitco… coin "## What I… 2010-07-13 active normal

## 2 2 Litecoin LTC litec… coin "## What I… 2013-04-28 active normal

## 3 3 Namecoin NMC namec… coin "Namecoin … 2013-04-28 active normal

## # ℹ 27 more variables: notice <chr>, alert_type <int>, alert_link <chr>,

## # latest_update_time <dttm>, watch_list_ranking <int>, date_launched <date>,

## # is_audited <lgl>, display_tv <int>, is_infinite_max_supply <int>,

## # tv_coin_symbol <chr>, cdp_total_holder <chr>, holder_historical_flag <lgl>,

## # holder_list_flag <lgl>, holders_flag <lgl>, ratings_flag <lgl>,

## # analysis_flag <lgl>, socials_flag <lgl>, has_extra_info_flag <lgl>,

## # upcoming <named list>, annotation_flag <lgl>, tags <list>, …

In a next step we show the logos of the three coins as provided by https://coinmarketcap.com.

In addition we show tags provided by https://coinmarketcap.com.

coin_info %>% select(slug,tags) %>% tidyr::unnest(tags) %>% group_by(slug) %>% slice(1,n())

## # A tibble: 6 × 2

## # Groups: slug [3]

## slug tags$slug $name $category

## <chr> <chr> <chr> <chr>

## 1 bitcoin mineable Mineable OTHERS

## 2 bitcoin 2017-2018-alt-season 2017/18 Alt season CATEGORY

## 3 litecoin mineable Mineable OTHERS

## 4 litecoin hoo-smart-chain-ecosystem Hoo Smart Chain Ecosystem PLATFORM

## 5 namecoin mineable Mineable OTHERS

## 6 namecoin platform Platform CATEGORY

Additionally: Here are some urls pertaining to these coins as provided by https://coinmarketcap.com.

coin_info %>% pull(urls) %>% .[[1]] |> unlist()

## urls.website urls.technical_doc

## "https://bitcoin.org/" "https://bitcoin.org/bitcoin.pdf"

## urls.explorer1 urls.explorer2

## "https://blockchain.info/" "https://live.blockcypher.com/btc/"

## urls.explorer3 urls.explorer4

## "https://blockchair.com/bitcoin" "https://explorer.viabtc.com/btc"

## urls.explorer5 urls.source_code

## "https://www.okx.com/web3/explorer/btc" "https://github.com/bitcoin/bitcoin"

## urls.message_board urls.reddit

## "https://bitcointalk.org" "https://reddit.com/r/bitcoin"

Coin Timeseries

In a next step we download time series data for these coins.

# retrieve historical data for all (the first 3) of them

coin_hist <- crypto_history(coins, limit=3, start_date="20210101", end_date="20210105", finalWait=FALSE)

## ❯ Scraping historical crypto data

##

## ❯ Processing historical crypto data

##

# and give the first two times of information per coin

coin_hist %>% group_by(slug) %>% slice(1:2)

## # A tibble: 6 × 17

## # Groups: slug [3]

## id slug name symbol timestamp ref_cur_id ref_cur_name

## <int> <chr> <chr> <chr> <dttm> <chr> <chr>

## 1 1 bitcoin Bitcoin BTC 2021-01-01 23:59:59 2781 USD

## 2 1 bitcoin Bitcoin BTC 2021-01-02 23:59:59 2781 USD

## 3 2 litecoin Litecoin LTC 2021-01-01 23:59:59 2781 USD

## 4 2 litecoin Litecoin LTC 2021-01-02 23:59:59 2781 USD

## 5 3 namecoin Namecoin NMC 2021-01-01 23:59:59 2781 USD

## 6 3 namecoin Namecoin NMC 2021-01-02 23:59:59 2781 USD

## # ℹ 10 more variables: time_open <dttm>, time_close <dttm>, time_high <dttm>,

## # time_low <dttm>, open <dbl>, high <dbl>, low <dbl>, close <dbl>,

## # volume <dbl>, market_cap <dbl>

Similarly, we could download data on an hourly basis.

# retrieve historical data for all (the first 3) of them

coin_hist_m <- crypto_history(coins, limit=3, start_date="20210101", end_date="20210102", interval ="1h", finalWait=FALSE)

## ❯ Scraping historical crypto data

##

## ❯ Processing historical crypto data

##

# and give the first two times of information per coin

coin_hist_m %>% group_by(slug) %>% slice(1:2)

## # A tibble: 6 × 17

## # Groups: slug [3]

## id slug name symbol timestamp ref_cur_id ref_cur_name

## <int> <chr> <chr> <chr> <dttm> <chr> <chr>

## 1 1 bitcoin Bitcoin BTC 2021-01-01 01:59:59 2781 USD

## 2 1 bitcoin Bitcoin BTC 2021-01-01 02:59:59 2781 USD

## 3 2 litecoin Litecoin LTC 2021-01-01 01:59:59 2781 USD

## 4 2 litecoin Litecoin LTC 2021-01-01 02:59:59 2781 USD

## 5 3 namecoin Namecoin NMC 2021-01-01 01:59:59 2781 USD

## 6 3 namecoin Namecoin NMC 2021-01-01 02:59:59 2781 USD

## # ℹ 10 more variables: time_open <dttm>, time_close <dttm>, time_high <dttm>,

## # time_low <dttm>, open <dbl>, high <dbl>, low <dbl>, close <dbl>,

## # volume <dbl>, market_cap <dbl>

Alternatively, we could determine the price of these coins in other

currencies. A list of such currencies is available as fiat_list()

fiats <- fiat_list()

fiats

## # A tibble: 1 × 4

## id name sign symbol

## <int> <chr> <chr> <chr>

## 1 2781 United States Dollar $ USD

So we download the time series again depicting prices in terms of

Bitcoin and Euro (note that multiple currencies can be given to

convert, separated by “,”).

# retrieve historical data for all (the first 3) of them

coin_hist2 <- crypto_history(coins, convert="USD", limit=3, start_date="20210101", end_date="20210105", finalWait=FALSE)

## ❯ Scraping historical crypto data

##

## ❯ Processing historical crypto data

##

# and give the first two times of information per coin

coin_hist2 %>% group_by(slug,ref_cur_name) %>% slice(1:2)

## # A tibble: 6 × 17

## # Groups: slug, ref_cur_name [3]

## id slug name symbol timestamp ref_cur_id ref_cur_name

## <int> <chr> <chr> <chr> <dttm> <chr> <chr>

## 1 1 bitcoin Bitcoin BTC 2021-01-01 23:59:59 2781 USD

## 2 1 bitcoin Bitcoin BTC 2021-01-02 23:59:59 2781 USD

## 3 2 litecoin Litecoin LTC 2021-01-01 23:59:59 2781 USD

## 4 2 litecoin Litecoin LTC 2021-01-02 23:59:59 2781 USD

## 5 3 namecoin Namecoin NMC 2021-01-01 23:59:59 2781 USD

## 6 3 namecoin Namecoin NMC 2021-01-02 23:59:59 2781 USD

## # ℹ 10 more variables: time_open <dttm>, time_close <dttm>, time_high <dttm>,

## # time_low <dttm>, open <dbl>, high <dbl>, low <dbl>, close <dbl>,

## # volume <dbl>, market_cap <dbl>

Historical Listings

As a new features in version 1.4.4. we introduced the possibility to

download historical listings and listing information (add

quote = TRUE).

latest_listings <- crypto_listings(which="latest", limit=10, quote=TRUE, finalWait=FALSE)

latest_listings

## # A tibble: 5,000 × 30

## id name symbol slug cmc_rank market_pair_count circulating_supply

## <int> <chr> <chr> <chr> <int> <int> <dbl>

## 1 1 Bitcoin BTC bitco… 1 11863 19810509

## 2 2 Litecoin LTC litec… 23 1300 75421662.

## 3 3 Namecoin NMC namec… 1072 7 14736400

## 4 5 Peercoin PPC peerc… 1117 42 29347489.

## 5 8 Feathercoin FTC feath… 1906 12 236600238

## 6 22 Luckycoin LKY lucky… 1225 10 12070868

## 7 25 Goldcoin GLC goldc… 2234 12 43681422.

## 8 26 Junkcoin JKC junkc… 2099 3 13961400

## 9 35 Phoenixcoin PXC phoen… 1919 4 91964756.

## 10 42 Primecoin XPM prime… 1776 5 52339064.

## # ℹ 4,990 more rows

## # ℹ 23 more variables: self_reported_circulating_supply <dbl>,

## # total_supply <dbl>, max_supply <dbl>, is_active <int>, last_updated <date>,

## # date_added <chr>, ref_currency <chr>, price <dbl>, volume24h <dbl>,

## # market_cap <dbl>, percent_change1h <dbl>, percent_change24h <dbl>,

## # percent_change7d <dbl>, percent_change30d <dbl>, percent_change60d <dbl>,

## # percent_change90d <dbl>, fully_dillutted_market_cap <dbl>, …

Aggregate Statistics

An additional feature that was added in version 1.4.5 retrieves global aggregate market statistics for CMC.

all_quotes <- crypto_global_quotes(which="historical", quote=TRUE)

## ❯ Scraping historical global data

##

## ❯ Processing historical crypto data

##

all_quotes

## # A tibble: 4,278 × 17

## timestamp btc_dominance eth_dominance score USD_total_market_cap

## <date> <dbl> <dbl> <dbl> <dbl>

## 1 2013-04-29 94.2 0 1367193600000 1583440000

## 2 2013-04-30 94.4 0 1367280000000 1686950016

## 3 2013-05-01 94.4 0 1367366400000 1637389952

## 4 2013-05-02 94.1 0 1367452800000 1333880064

## 5 2013-05-03 94.2 0 1367539200000 1275410048

## 6 2013-05-04 93.9 0 1367625600000 1169469952

## 7 2013-05-05 94.0 0 1367712000000 1335379968

## 8 2013-05-06 94.1 0 1367798400000 1370880000

## 9 2013-05-07 94.4 0 1367884800000 1313900032

## 10 2013-05-08 94.4 0 1367971200000 1320509952

## # ℹ 4,268 more rows

## # ℹ 12 more variables: USD_total_volume24h <dbl>,

## # USD_total_volume24h_reported <dbl>, USD_altcoin_volume24h <dbl>,

## # USD_altcoin_volume24h_reported <dbl>, USD_altcoin_market_cap <dbl>,

## # USD_original_score <chr>, active_cryptocurrencies <int>,

## # active_market_pairs <int>, active_exchanges <int>,

## # total_cryptocurrencies <int>, total_exchanges <int>, origin_id <chr>

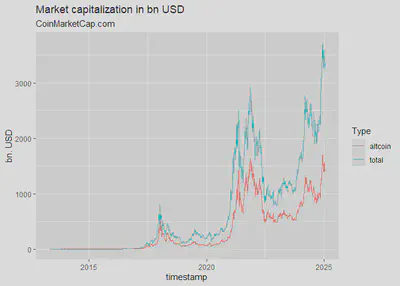

We can use those quotes to plot information on the aggregate market capitalization:

all_quotes %>% select(timestamp, USD_total_market_cap, USD_altcoin_market_cap) %>%

tidyr::pivot_longer(cols = 2:3, names_to = "Market Cap", values_to = "bn. USD") %>%

tidyr::separate(`Market Cap`,into = c("Currency","Type","Market","Cap")) %>%

dplyr::mutate(`bn. USD`=`bn. USD`/1000000000) %>%

ggplot2::ggplot(ggplot2::aes(x=timestamp,y=`bn. USD`,color=Type)) + ggplot2::geom_line() +

ggplot2::labs(title="Market capitalization in bn USD", subtitle="CoinMarketCap.com")

Exchange Information

Last and least, one can get information on exchanges. For this download

a list of active/inactive/untracked exchanges using exchange_list():

exchanges <- exchange_list(only_active=TRUE)

exchanges

## # A tibble: 778 × 6

## id name slug is_active first_historical_data last_historical_data

## <int> <chr> <chr> <int> <date> <date>

## 1 16 Poloniex polo… 1 2018-04-26 2025-01-15

## 2 21 BTCC btcc 1 2018-04-26 2025-01-15

## 3 24 Kraken krak… 1 2018-04-26 2025-01-15

## 4 34 Bittylicious bitt… 1 2018-04-26 2025-01-15

## 5 36 CEX.IO cex-… 1 2018-04-26 2025-01-15

## 6 37 Bitfinex bitf… 1 2018-04-26 2025-01-15

## 7 42 HitBTC hitb… 1 2018-04-26 2025-01-15

## 8 50 EXMO exmo 1 2018-04-26 2025-01-15

## 9 61 Okcoin okco… 1 2018-04-26 2025-01-15

## 10 68 Indodax indo… 1 2018-04-26 2025-01-15

## # ℹ 768 more rows

and then download information on “binance” and “bittrex”:

ex_info <- exchange_info(exchanges %>% filter(slug %in% c('binance','kraken')), finalWait=FALSE)

## ❯ Scraping crypto info

##

## ❯ Processing exchange info

##

ex_info

## # A tibble: 2 × 19

## id name slug logo description date_launched notice is_hidden status

## <int> <chr> <chr> <chr> <chr> <date> <chr> <int> <chr>

## 1 24 Kraken kraken https… "## What I… 2011-07-28 "" 0 active

## 2 270 Binance binance https… "## What I… 2017-07-14 "" 0 active

## # ℹ 10 more variables: type <chr>, maker_fee <dbl>, taker_fee <dbl>,

## # platform_id <int>, dex_status <int>, wallet_source_status <int>,

## # tags <lgl>, countries <lgl>, fiats <list>, urls <list>

Then we can access information on the fee structure,

ex_info %>% select(contains("fee"))

## # A tibble: 2 × 2

## maker_fee taker_fee

## <dbl> <dbl>

## 1 0.02 0.05

## 2 0.02 0.04

or the fiat currencies allowed:

ex_info %>% select(slug,fiats) %>% tidyr::unnest(fiats)

## # A tibble: 18 × 2

## slug fiats

## <chr> <chr>

## 1 kraken "USD"

## 2 kraken "EUR"

## 3 kraken "GBP"

## 4 kraken "CAD"

## 5 kraken "JPY"

## 6 kraken "CHF"

## 7 kraken "AUD"

## 8 binance "EUR"

## 9 binance " GBP"

## 10 binance " BRL"

## 11 binance " AUD"

## 12 binance " UAH"

## 13 binance " RUB"

## 14 binance " TRY"

## 15 binance " ZAR"

## 16 binance " PLN"

## 17 binance " NGN"

## 18 binance " RON"

Package Information

Author

- Sebastian Stöckl - Package Creator, Modifier & Maintainer - sstoeckl on github

Acknowledgments

- Thanks to the team at https://coinmarketcap.com for the great work they do, especially to Alice Liu (Research Lead) and Aaron K. for their support with regard to information on delistings.

- Thanks to Jesse Vent for providing the (not fully research

compatible)

crypto-package that inspired this package.

References

Bouri, Elie, Rangan Gupta, and David Roubaud. 2018. “Herding Behaviour in Cryptocurrencies.” Finance Research Letters, July. https://doi.org/10.1016/j.frl.2018.07.008.

Brauneis, Alexander, and Roland Mestel. 2018. “Price Discovery of Cryptocurrencies: Bitcoin and Beyond.” Economics Letters 165: 58–61. https://doi.org/10.1016/j.econlet.2018.02.001.

Corbet, Shaen, Andrew Meegan, Charles Larkin, Brian Lucey, and Larisa Yarovaya. 2018. “Exploring the Dynamic Relationships Between Cryptocurrencies and Other Financial Assets.” Economics Letters 165 (April): 28–34. https://doi.org/10.1016/j.econlet.2018.01.004.