PRIX – A risk index for global private investors

Abstract

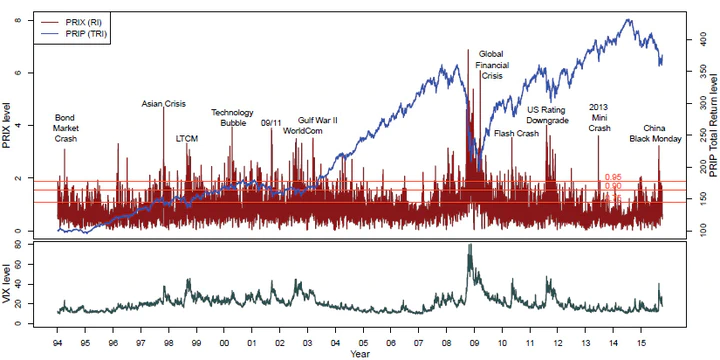

Purpose - The purpose of this paper is to create a universal (asset-class-independent) portfolio risk index for a global private investor. Design/methodology/approach – The authors first discuss existing risk measures and desirable properties of a risk index. Then, they construct a universal (asset-class-independent) portfolio risk measure by modifying Financial Turbulence of Kritzman and Li (2010). Finally, the average portfolio of a representative global private investor is determined, and, by applying the new portfolio risk measure, they derive the Private investor Risk IndeX. Findings – The authors show that this index exhibits commonly expected properties of risk indices, such as proper reaction to well-known historical market events, persistence in time and forecasting power for both risk and returns to risk. Practical implications – A dynamic asset allocation example illustrates one potential practical application for global private investors. Originality/value – As of now, a risk index reflecting the overall risk of a typical multi-asset-class portfolio of global private investors does not seem to exist.