Bid-Ask Spread Patterns and the Optimal Timing for Discretionary Liquidity Traders on Xetra

2018-07-01·, ,,,·

0 min read

,,,·

0 min read

Martin Angerer

Georg Peter

Sebastian Stöckl

Thomas Wachter

Matthias Bank

Marco Menichetti

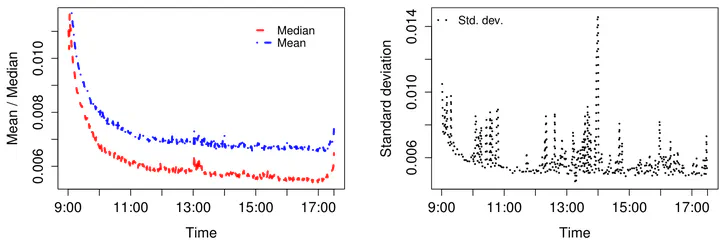

The left-hand side figure shows the cross-sectional mean and median relative bid-ask spread for each minute of a trading day. The plot on the right-hand side depicts the intra-day dynamics of the crosssectional standard deviation of the relative bid-ask spread.

The left-hand side figure shows the cross-sectional mean and median relative bid-ask spread for each minute of a trading day. The plot on the right-hand side depicts the intra-day dynamics of the crosssectional standard deviation of the relative bid-ask spread.Abstract

This paper explores the statistical and economical significance of intraday and -week patterns in bid-ask spreads. We investigate a large panel of high frequency data for stocks traded on the XETRA trading platform and observe significant patterns in spreads. In addition to showing the robustness of our findings over time, as well as in cross-section, we are also able to demonstrate the patterns’ predictability in an out-of-sample approach. Our findings have clear implications, especially for uninformed but discretionary liquidity traders, which allow significant and economically relevant reductions of transaction costs.

Type

Publication

Schmalenbach Business Review, 70(3), 209-230