Less Is More: Granularity of Information, Estimation Errors and Optimal Portfolios

Abstract

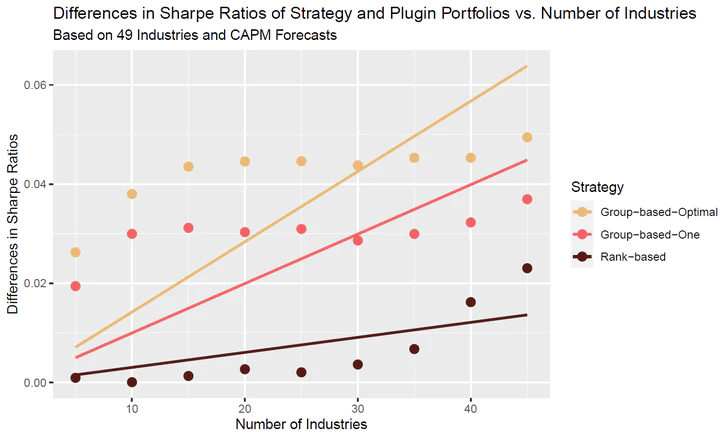

We offer a novel approach that aims at mitigating the crippling effects that parameter uncertainty and estimation errors have on the out-of-sample performance of mean-variance optimized portfolios. We argue that investors should not rely on exact forecasts when optimizing portfolios but instead based their optimizations on ranking or grouping information and thereby implicitly reduce the informational content of their parameter inputs. Our suggestions are based on the notion that reducing the informational content of input parameters eliminates outliers caused by estimation errors which in turn means that mean-variance optimization suggests less extreme weights resulting in an overall better diversified and less concentrated portfolio. Our results confirm that our approach statistically and economically significantly improves Sharpe ratios of optimized portfolios compared to the plug-in mean-variance approach and relative to naively diversified portfolios. Furthermore, our approach is more effective when estimation errors are expected to be larger and with decreasing forecast accuracy.