Diversifying Estimation Errors with Unsupervised Machine Learning

Abstract

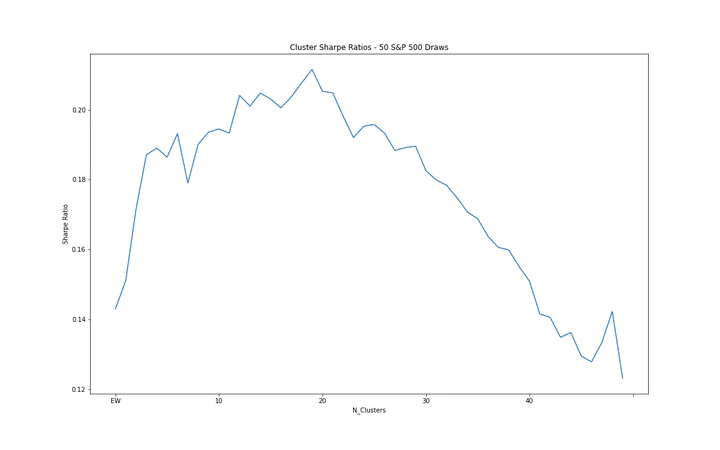

Regarding the disastrous impact of estimation errors on portfolio optimization, this paper investigates the trade-off between optimization and estimation errors using unsupervised machine learning. Our model uses unsupervised machine learning to reduce estimation errors by clustering stocks into equally weighted portfolios which in turn are plugged into the classical minimum variance optimization. In contrast to previously documented results, the clustered optimization does beat the equally weighted portfolio considerably in all setups. Varying the number of clusters from one (the equally weighted portfolio) to $N$ (the minimum variance portfolio) we find the optimal number of clusters to be approximately $N/4$.

Type

Publication

Working Paper