News

- 2023/02 - Our paper Regime-Dependent Drivers of the EUR/CHF Exchange Rate (joint work with Piotr Kotlarz and Michael Hanke) has been published in the Swiss Journal of Economics and Statistics

- 2023/02 - I represented the University of Liechtenstein at the AACSB Deans Conference in San Antonio, USA.

Sebastian Stöckl

Assistant Professor in Financial Economics (tenure-track)

University of Liechtenstein

Tweets

Tweets by StoecklSebBiography

Information

- Assistant Professor (tenure-track) in Financial Economics, University of Liechtenstein (Profile)

- Academic Head of the Liechtenstein Undergraduate & Graduate School

- Official Representative AACSB

- Project Leader, Understanding Saving in Europe, Investment Management Game

- Teaching in BSc, MSc, PhD, and Continuing Education (MBA,EMBA)

- Visiting Lecturer at the MCI Innsbruck (formerly: University of Innsbruck, Ramkhamhaeng University Bangkok [Thailand])

- Organizer of the University of Liechtenstein’s Finance Research Seminar

- Co-Organizer of the Wirtschaftspolitisches Seminar Alpenrhein (Economic Policy Seminar “Alpenrhein”)

About me

I am currently a tenure-tracked Assistant Professor in Financial Economics at the University of Liechtenstein. I received my Ph.D. in Economics from the University of Innsbruck and also am the holder of two graduate degrees in Business Administration and Technical Mathematics, both also from the University of Innsbruck.

My research interest covers all areas of uncertainty, e.g. (i) parameter uncertainty, (ii) financial uncertainty, (iii) macroeconomic uncertainty and (iv) political uncertainty and I have published several papers on these topics in Finance and Economics Journals.

My teaching spans topics from Research Methods in Finance to Econometrics, to Portfolio Management and Financial Analysis or Derivatives and ranges from Bachelor to PhD level courses and executive education (MBA, EMBA) at the University of Liechtenstein and the MCI Innsbruck. Additionally I am the project coordinator/leader for two Erasmus+ projects where we develop online courses in the field of Life-Cycle Planing and Pension Finance, as well as the Innosuisse project ‘An ESG-based Investment Case for Absolute Return Funds’.

Since mid 2022 I am the Academic Head of the Liechtenstein Undergraduate & Graduate School as well as the official representative of the University of Liechtenstein to AACSB.

My R-packages

| Logo | Description |

|---|---|

| my crypto2-package to retrieve survivorship bias free crypto currency data from https://coinmarketcap.com |

| my ffdownload-package to retrieve research data from Kenneth French’s famous website |

Publications

Selected publications

Preprint PDF Cite DOI JOURNAL OF ECONOMIC BEHAVIOR & ORGANIZATION Macroeconomic Analysis & International Finance 2020 European Public Choice Society 2019 Public Choice Workshop 2019 (Pamplona) Wifo (Vienna)

Preprint PDF Cite DOI REVIEW OF FINANCIAL ECONOMICS SGF 2017

PDF Cite Dataset DOI JOURNAL OF BANKING AND FINANCE Quantitative Methods in Finance 2019

Working Papers

Selected Working Papers

Research Projects

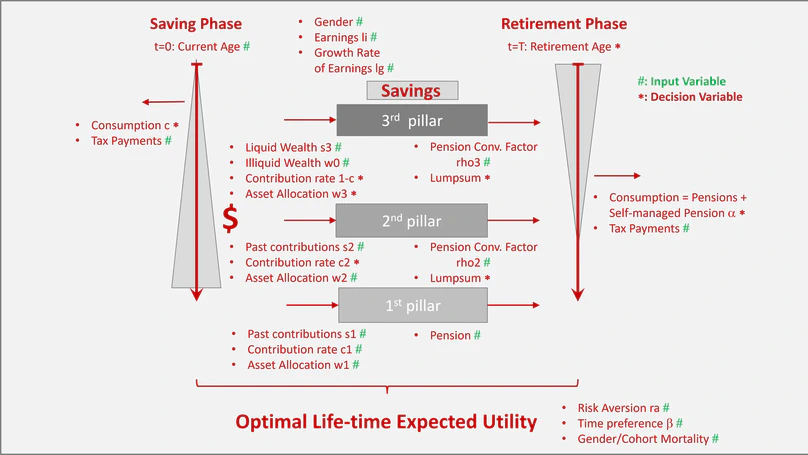

Overview In this project we developed an R-package (available through github at https://github.com/sstoeckl/pensionfinanceLi) to optimize decisions individuals in Liechtenstein’s pension system have to take. The package contains several optimizers as well as a documentation (available through vignette("model") once the package is installed).

Contact

- sebastian.stoeckl@uni.li

- +423 265 1153

-

Muehleweg 5

9490 Vaduz - 1st floor

- Thursday 13:00 to 14:00

- Book an appointment

- DM Me

- Zoom Me